“Legally Eliminate Your Income Taxes & Keep 100% of Your Earnings!”

Register For Our Weekly 12-411 Infosession

Join our Weekly 12-411 Info Session for a live Q&A with CPAs, real client testimonials, and expert insights—get all your questions answered and gain the confidence to legally eliminate your income tax with Wealth Guaranteed’s 12-411 Process!

Secure Your Financial Future Today

Join Our Exclusive 12-411 Webinar & Discover How to Achieve Tax-Free Wealth

Learn how to legally eliminate 100% of your federal & state income taxes

Hear real client testimonials & expert insights

Get your questions answered in our live Q&A

See how the wealthy pay ZERO in taxes—and how you can too

Financial Solutions for Every Life Stage

We offer wealth accumulation, retirement planning, investment management, tax strategies, and estate planning to meet your financial goals.

Wealth Accumulation Strategies

Boost your wealth with tailored investments, savings strategies, and smart budgeting.

Retirement Planning Solutions

Secure your retirement with personalized plans tailored for a fulfilling life after work.

Tax Optimization & Estate Planning

Preserve your wealth with expert tax planning and estate management for future generations

Speakers

— David M

Founder & Chief Consultant

Managing finances with unpredictable income can be tricky, but it’s not impossible! Join me in this webinar where I’ll talk about the tools and techniques I’ve adopted to handle irregular income, save consistently, and stay prepared for tax season. Financial planning is key to stability, and I can’t wait to show you how I’ve made it work.

— Kobe A

Client Success Manager

If you’ve ever felt overwhelmed by freelance finances, this webinar is for you! I’ll be discussing how separating personal and business finances has transformed the way I manage my money. I’ll also share insights on retirement planning, because even freelancers need to plan for the future!

Missed Last Weeks Infosession?

"Taxes were a nightmare for me every year. I'm so happy I don't have to do that anymore! This process is simple, it’s easy to follow, and it makes sense! Once you get used to this process it becomes second nature, and you'll never want to go back.”

- Celina, New York 2/27/2025

Celina, New York

Got Question?

We've got answers!

Navigating the 12-411 process may bring up questions, and we’re here to provide clarity every step of the way. Our team has compiled answers to the most common concerns about legally eliminating your income tax, maximizing your refund, and staying compliant with federal regulations.

Whether you need insights on how the process works, what steps to take next, or how this applies to your specific financial situation, our FAQ section has you covered.

If you don’t find your question listed, don’t worry—we’re here to help! Ask us anything during the webinar or reach out directly, and our team will be happy to assist you.

What is 12 USC § 411?

It is a section of U.S. law that allows individuals to redeem otherwise taxable Federal Reserve Notes for lawful money, which is non-taxable. This was part of the original federal reserve act & has been on our law books for well over 100 years.

If this process works so well, why have I never heard of it? Why aren’t the financially privileged using it?

The truth is, the wealthy and elite in this country have been using strategies like our 12-411 process for generations. However, they’ve done an excellent job of keeping the public misinformed about how it works. By allowing everyday Americans to be confused by the complexity of offshore trusts, foreign bank accounts, or secretive accounts in places like Dubai or Switzerland, they’ve convinced the general public that tax exemption is something only the ultra-wealthy can achieve. This confusion isn’t accidental, it’s intentional. Our 12-411 process is actually simple and legal, but it’s hidden in plain sight. If a wealthy person were to explain it in casual conversation, it might sound far-fetched to the average person because our education system has trained Americans to dismiss what’s been right in front of them all along. For the wealthy, it’s easier—and more beneficial—to stay quiet about these strategies and let the public remain uninformed. Teaching everyday Americans about these processes would disrupt the system they’ve benefited from for so long. Unlike the wealthy elite, we at Wealth Guaranteed are committed to educating and empowering everyday people to use these same tools to gain financial freedom and achieve tax exemption. We’ve made it our mission to bring these legal, proven strategies to everyone, not just the privileged few.

Why am I having a hard time finding information on the 12-411 process online? Are there forms I can use to do this myself?

The 12-411 Process is a proprietary process developed exclusively by Wealth Guaranteed to legally eliminate your income tax liability using 12 U.S.C. 411. There are no government-provided forms or official guides to help you with this process. While Congress wrote into law that we have the right to redeem our income in lawful money (which makes it non-taxable), they provide no official assistance, tutorials, or standardized paperwork to facilitate this process. The expectation is that anyone wanting to take advantage of this right must research and interpret the law themselves. Additionally, popular search engines intentionally scramble or suppress this information, allowing misleading or incorrect interpretations to spread in an effort to discourage the general public from successfully applying this process. This is why accurate and reliable information on the 12-411 process is difficult to find online. The 12-411 Process as we teach it was developed in-house by Wealth Guaranteed and refined over six years with a 100% success rate. Our founder coined the term “12-411 Process” to describe our exclusive 15-step methodology that ensures the successful application of 12 U.S.C. 411 for total tax elimination. In 2024, we launched our proprietary 12-411 automation software, a revolutionary system that streamlines the entire process, reducing the time needed to complete the program from four months to just two weeks. This software allows you to effortlessly complete each step while Wealth Guaranteed handles the hard work, including:

Video tutorials on the tax elimination process Government agency document creation

Done for you government communication

Prefilled Withholding Exempt forms for all 50 states

With direct communication channels with multiple government agencies, our team ensures that every step is executed correctly on your behalf. By working with Wealth Guaranteed, you gain access to an exclusive, proven system that ensures a smooth and legally sound tax exemption process without the guesswork.

What if the government changes the law and takes away 12 USC 411?

When President Franklin D. Roosevelt confiscated all the gold in 1933 through Executive Order 6102, the federal government needed a remedy to counterbalance this massive action. As a result, Title 12 was expanded to include language from Section 16.1 of the original Federal Reserve Act, which states that Federal Reserve Notes may be redeemed for lawful money upon demand. This law was essentially a trade-off: the government seized the nation’s gold, and in return, provided a legal mechanism for individuals to convert their taxable Federal Reserve Notes into non-taxable lawful money. However, since so few people understand or exercise this right, the system overwhelmingly benefits the government and the Federal Reserve. They got to confiscate gold from the American people, while retaining control of the monetary system, and only a small fraction of people use the remedy provided to opt out of income taxes. The government has no incentive to change 12 USC 411 because the law works perfectly for their interests. The ultra-wealthy and those who understand the law take full advantage of it, while 99% of everyday Americans remain unaware and continue to voluntarily comply with income tax regulations. Changing the law would only draw attention to it, which would disrupt this arrangement. The responsibility falls on individuals to understand and apply the law. If you fail to use 12 USC 411 to declare your income as non-taxable, the blame rests on you, not the government. Since most Americans never apply this remedy, there’s no reason for the government to alter or repeal the law—it’s already serving their purposes effectively.

What if the government changes the law and takes away 12 USC 411?

When President Franklin D. Roosevelt confiscated all the gold in 1933 through Executive Order 6102, the federal government needed a remedy to counterbalance this massive action. As a result, Title 12 was expanded to include language from Section 16.1 of the original Federal Reserve Act, which states that Federal Reserve Notes may be redeemed for lawful money upon demand. This law was essentially a trade-off: the government seized the nation’s gold, and in return, provided a legal mechanism for individuals to convert their taxable Federal Reserve Notes into non-taxable lawful money. However, since so few people understand or exercise this right, the system overwhelmingly benefits the government and the Federal Reserve. They got to confiscate gold from the American people, while retaining control of the monetary system, and only a small fraction of people use the remedy provided to opt out of income taxes. The government has no incentive to change 12 USC 411 because the law works perfectly for their interests. The ultra-wealthy and those who understand the law take full advantage of it, while 99% of everyday Americans remain unaware and continue to voluntarily comply with income tax regulations. Changing the law would only draw attention to it, which would disrupt this arrangement. The responsibility falls on individuals to understand and apply the law. If you fail to use 12 USC 411 to declare your income as non-taxable, the blame rests on you, not the government. Since most Americans never apply this remedy, there’s no reason for the government to alter or repeal the law—it’s already serving their purposes effectively.

Can you explain how the Federal Reserve Creates Money Out of Thin Air & Why High Taxes are needed to Maintain the Illusion of Government Funding?

The Federal Reserve operates under a system called “fractional reserve banking,” which allows money to be created from nothing. Here’s how it works:

Step 1: The Federal Reserve “Buys” Treasury BondsWhen the U.S. government needs money, it issues Treasury Bonds—essentially IOUs that promise to pay interest in the future. The Federal Reserve “buys” these Treasury Bonds, but instead of using real money, it simply creates new dollars out of thin air by making a digital entry on a computer.

• The Fed doesn’t have a vault full of cash to hand over—it literally invents money on demand to purchase these bonds.• The government now has these newly created dollars to spend, increasing the overall money supply.

Step 2: The Illusion of “Government Funding” Through TaxesMost people believe that their tax dollars fund the government—that the IRS collects money, and then Congress distributes it to pay for public services. This is false.

• In reality, the government already gets all the money it needs from the Federal Reserve creating new dollars whenever necessary.

• Taxes are not needed to fund spending—the U.S. government could operate without collecting a single dollar in taxes if it wanted to. So why are taxes still so high? Because high taxes serve a psychological and economic purpose:

Step 3: High Taxes Maintain Confidence in the Dollar The entire global economy depends on people believing the U.S. dollar has value. The dollar is a fiat currency, meaning it has no intrinsic value—its worth is purely based on faith and confidence in the U.S. government.

• Taxes create the illusion of scarcity. When people believe that money is hard to come by because of taxes, they place higher value on the dollars they earn and spend.

• If people realized taxes weren’t necessary, they might question why they are paying them—which could erode confidence in the system.• A tax-free economy would expose how money is created from nothing, leading to widespread distrust in the government and the financial system.

Step 4: Inflation and DebtEvery time the Federal Reserve creates new money, it dilutes the value of the existing money supply. This leads to inflation, which is essentially an invisible tax on every American. Instead of directly taking your money through taxes, the government erodes your purchasing power by printing more money.

• The national debt is never meant to be paid off—it keeps growing indefinitely because the system is designed for perpetual borrowing and spending.

• If Americans stopped paying taxes altogether, the government would still continue operating exactly the same way—by printing more money. The Truth About Taxes

• Taxes are a form of economic control, not a necessity for government funding.

• The real purpose of taxation is to keep the public in check, create artificial scarcity, and prevent people from realizing the truth about how money is created.

• Those who understand this system—the ultra-wealthy and corporations—use 12 USC 411 to opt out of income taxes completely while everyday Americans continue to foot the bill. How to Opt Out of the US Income Tax Legally

- Use Wealth Guaranteed’s 12-411 Process.

Our 12-411 process allows Americans to legally opt out of paying income taxes by using a little-known federal law that lets you redeem Federal Reserve Notes for lawful money—making your income non-taxable. By understanding how money is really created and how the tax system truly works, you can legally remove yourself from the tax trap and take control of your financial future. Join our live Infosession this Thursday to learn how to eliminate your tax liability and get a 100% tax refund every year!

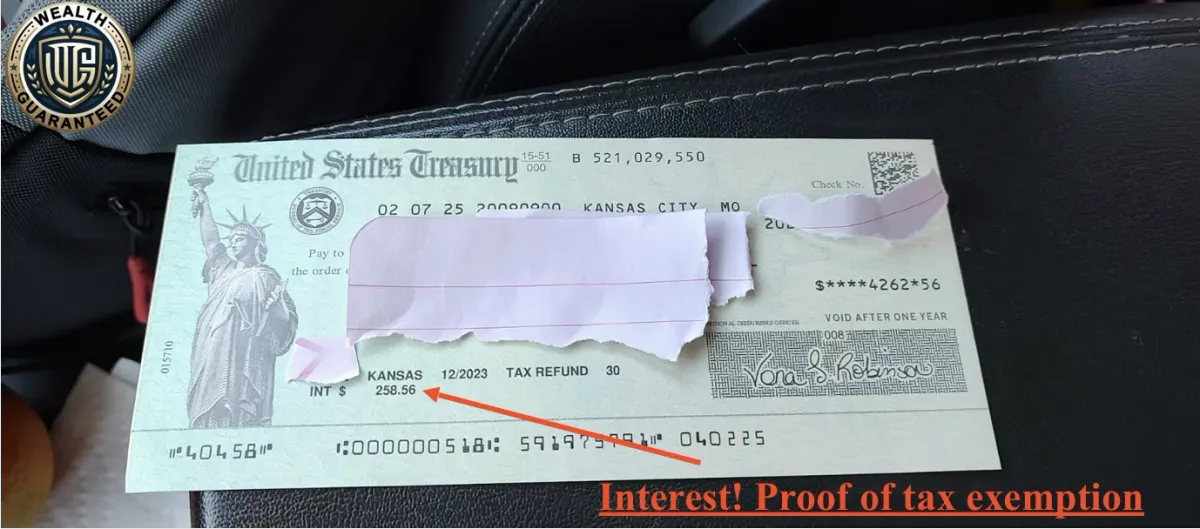

How does this process affect state income tax? Will I still need to pay?

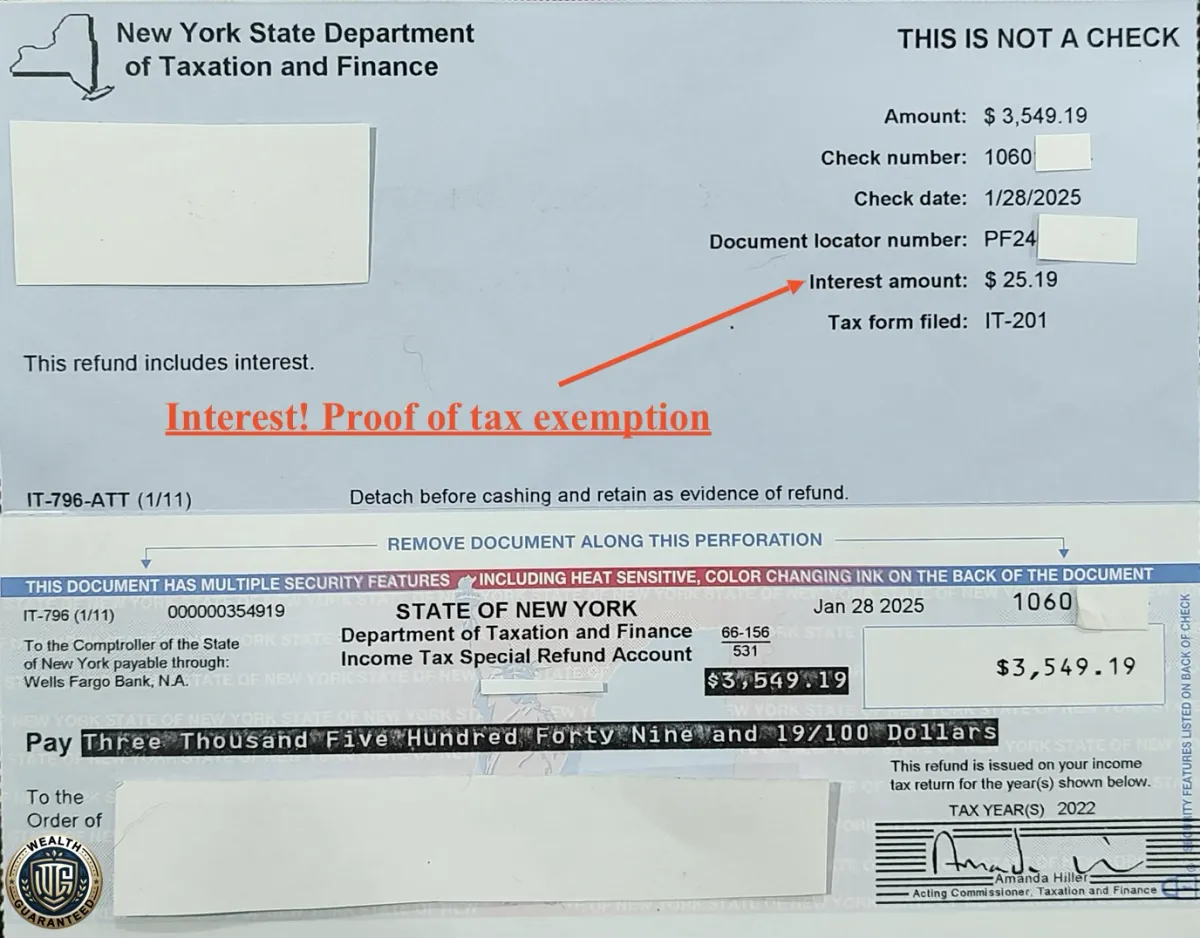

With our 12-411 process, your federal and state tax bill will always be $0—no exceptions. This process legally eliminates your taxable income, meaning there is no federal income tax liability and, by extension, no state income tax liability in any state that imposes an income tax (which is nearly all of them). If any taxes were withheld from your pay, you will receive 100% of that money back when you file with our process. Our system is designed to ensure you never owe income tax again—federally or at the state level. If you live in a state that does impose an income tax, our NoTaxPros will prepare your state tax return with our 12-411 process, resulting in you receiving a 100% refund check from both the federal tax collector and your state taxation authority.

Have any of your 12-411 clients been challenged by state or federal Tax Collectors? What’s the worst that’s happened?

No, none of our 12-411 clients have ever been challenged by the IRS or state tax collectors. The worst thing that happens? Occasionally, the IRS may send a letter stating they need more time to review the tax return. This is completely normal and nothing to be concerned about, as no one in the United States can control how long the IRS takes to process tax returns. What’s most important is that in our six-year history, the IRS has never challenged, rejected, or denied a properly filed 12-411 tax return. Every client who has followed the process correctly has received a 100% refund and a $0 tax bill—just as the law allows.

How can I be assured that this isn’t “too good to be true?”

We completely understand the skepticism—many of our clients felt the same way before learning how the 12-411 process legally eliminates income tax. However, what makes this different from “too good to be true” schemes is federal law. 12 USC 411 has been part of the U.S. legal code for over 100 years, and the IRS itself acknowledges that the tax system is based on voluntary compliance (26 CFR 601.602(a)). Additionally, Wealth Guaranteed has a 100% success rate with our 12-411 Process.. Every client who has followed our process has had their tax bill reduced to zero and received a full refund of their federal and state taxes paid. For extra assurance, we invite you to our weekly live Infosession, where you can meet CPAs, tax professionals, and real clients who have successfully used this process. This is not a loophole or a trick—it’s simply applying the law correctly in a way most people don’t know about. Still unsure? Join our next Infosession or call our office at 737-285-4285 and ask us anything!

Unlock Your Path to Tax Freedom

Are you ready to eliminate your income taxes legally and take full control of your financial future?

Discover the Proven Strategy to Keep 100% of Your Income—Forever